It is hard to resist not commenting on Donald Trump’s views, so I will if just briefly. In this instance the comment is over Kamala Harris’s racial makeup. It is ‘weird’ as the Democrats have started saying. In fact that barely describes his comments on her. Mind you, I doubt that it is the last time we will hear such ‘jaw dropping insights’ from Trump when it comes to his likely opponent Kamala Harris.

All right, let’s turn to today’s focus – the state of US-China relations following China’s Third Plenum – really focusing on the Third Plenum. This gathering is the Third Plenum of the 20th Party Congress, which brought together the Party’s top leadership, including all the members of the Central Committee and the Politburo of the Chinese Communist Party. Third Plenums in particular have especially been closely followed. Why? Well, it really began with the Third Plenum of the 11th Party Congress in December 1978. That Third Plenum ushered in a series of policy changes championed at the time by Deng Xiaoping. This Plenum was in retrospect the start of the ‘Reform and Opening Era’ which was followed by the Third Plenum of the 14th Party Congress when the leadership identified the goal of creating a ‘socialist market economy’. And, at the 18th Party Congress in November 2013, the CCP emphasized in that Third Plenum, “the decisive role of the market in allocating resources,”. So, it is not unreasonable for experts, officials, etc. to look at each 5-year Third Plenum to identify signals for domestic economic reform which many then anticipate impacts on the global economy with China’s increasingly central role on the international economy.

It’s not a surprise, then, that there was a degree of anticipation for this Third Plenum which had been postponed for months, especially given the flagging Chinese economy. Our colleagues at CSIS including Jude Blanchette and Scott Kennedy described the tortured passage of policy creation:

According to a CCP website, the document went through 38 drafts. Right after the conclave ended, the CCP issued a communique (English, Chinese) summarizing the results of the meeting. On Sunday, July 21, the text of the full, far more detailed Decision (English, Chinese) was issued, which provides a stronger foundation for evaluating the meeting’s significance.

So where are we and what consequences are likely to follow the policy pronouncements?

There was a lot of anticipation. As pointed out by Bert Hofman in his Substack Post:

This year’s third plenum was highly anticipated due to several factors. The multitude of structural challenges that China’s economy is facing—debt, demographics, demand, deflation, and decoupling—require the robust economic reforms that third plenums tend to deliver. Second, China’s propaganda machine had built up the plenum’s importance, comparing it with breakthrough plenums of the pasts.

But for most analysts the outcomes have been rather disappointing. As pointed out, again by Bert Hofman, the hoped for policy tilt and more toward markets and/or greater domestic consumption is not evident in the Declaration:

This year’s plenum has dropped the decisive role of the market. Instead, it proposes that the party should “better leverage the role of the market.” This is hardly an encouragement of the private sector, whose confidence is still recovering from regulatory crackdowns and COVID lockdowns. At the same time, in a press conference after the conclusion of the plenum Han Wenxiu, deputy director of the Central Financial and Economic Affairs Commission’s general office, and a main drafter of the plenum decision document, said that it was “necessary to create a favourable environment and provide more opportunities for the development of the private sector” in China.

Nevertheless, the omission of the market’s decisive role is in line with the more statist view on development that has been gaining grounds under Xi Jinping, and that the private sector will be increasingly guided by the party and restricted by regulation.

But the nature of reforms has changed—whereas in previous plenums reforms were predominantly aimed at facilitating marketization and liberalization of China’s economy, they are now meant to strengthen the policies and institutions that underpin Xi Jinping’s view of the world.

The party-state dominance seems to be fully in charge. And China can be expected to stay the current course for domestic economic growth and prosperity. As Scott Kennedy argues:

The Communique and Decision give the distinct impression that despite the economy’s various structural problems and cyclical downturn, the CCP is not going to change course, but instead will intensify its efforts to steer the economy on to a sustainable long-term path. The central focus for generating “high-quality development” will be on expanding focus on advanced technologies, what are now ideologically described as “new productive forces” (新质生产力).

That said, the Plenum’s analysis and policy proposals on the economy are likely to draw a more skeptical reaction from a variety of corners, domestic and international, because of its deeply statist focus: 1) A strong emphasis on the central role of China’s party-state in directing the economy; 2) The prioritization on investment and production as the drivers of growth and far less attention to consumption and households; 3) Continued support for the “public sector” and state-owned enterprises (SOEs) even while pledging to create a level playing field for private firms; 4) A discussion of the global economy that proposed incremental expanded market access to China while stressing the need for China to leverage its large market for its own benefit; and 5) The expansive discussion of national security and the need to align economic policy with national security, which as Jude Blanchette notes, is centered around the security of the CCP.

Scott’s colleague at CSIS, Claire Reade, underlines that trade partners are unlikely to be fooled by this Plenum Declaration and trade tensions as a result are unlikely to abate and that’s without taking into account the likely economic earthquake of a second Trump Administration:

The latest Third Plenum Decision declares that “overall, we have accomplished the reform tasks” set out in 2013. Since this is patently not the case, it is particularly discouraging. The decision ironically then highlights the gap between its triumphant conclusion and reality by going on to pledge that by 2029, the market will determine the allocation of resources, and private domestic and foreign enterprises will obtain equal treatment with state-owned enterprises.

On balance, trading partners need to continue to be savvy and proactive in taking steps to protect their economies against this massive, state-heavy economy, and companies need to look carefully at their own risk management.

It is not surprising that various Chinese experts are suggesting that a more incremental approach was always a more likely approach of the President and the Party. Here is Huang Yiping, who is the Dean of the National School of Development at Beida, or Peking University, assessing on the Pekinology Substack Post the policy approach coming out of the Third Plenum:

The first point you probably all saw is that the Asian market dropped after the Third Plenum, especially after the full document was out. So some people felt a little bit pessimistic. My own sense, my take, is that the market was probably too optimistic about what they should expect.

So some people felt a little bit pessimistic. My own sense, my take, is that the market was probably too optimistic about what they should expect.

In fact, if you were paying attention to what the President himself was saying and the message government officials were trying to convey to the public. It was pretty clear this would not be a grand-scale liberalization program. This will be about reform, about modernization. But the key approach, the President outlined himself very clearly. He called it running towards the problems and trying to correct them. So it’s more like a down-to-earth and very practical approach—when you try to see the problems, you try to overcome them.

So when you say, well, the market is disappointed. That’s probably true, but either because the expectation was just overly too high or No. 2, I think the reason why investors are not very upbeat at the moment is because the macroeconomy is not doing particularly well.

Huang Yiping is aware, however, of the consumption problem:

Weak consumption causes two problems. No. 1 is you obviously would easily end up with a domestic overcapacity problem, right? You produce a lot, you invest a lot, and then the final consumption demand is very weak. That means there will be a certain portion of the capacity you cannot find domestic buyers for, and you call it overcapacity. That’s why during the last 45, 46 years of Chinese reform, we almost always had the overcapacity problem.

I think the macroeconomic problem is there is a macro imbalance. Consumption and demand and supply are not very balanced. So that’s one big issue.

So where does that leave us? I anticipate there will be continuing if not growing trade tensions with the US and with Europe as well as China continues its ferocious pace of manufacturing exports and fails to encourage greater domestic consumption. At least to constrain these tensions and protective trade actions in the absence of the WTO, it might be useful to try and negotiate VERs – ‘voluntary export restraints’ with China. It is not optimal – far from it – but it could avoid a trade ‘bloodbath’.

An important opportunity has been missed for the moment and may in fact be even more dramatically lost if Donald Trump wins the next election in November. Let’s hope the US electorate is smarter than that.

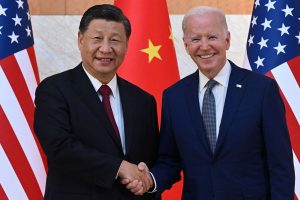

Image Credit: CNN